jefferson parish property tax search

Run by the Jefferson Parish Public Information Office JPTV is committed to making local government proceedings transparent and. LatestStatementYear Statement LatestStatementStatementNumber Mill Levy Rate.

Property Assessment Faq St Tammany Parish Assessor S Office

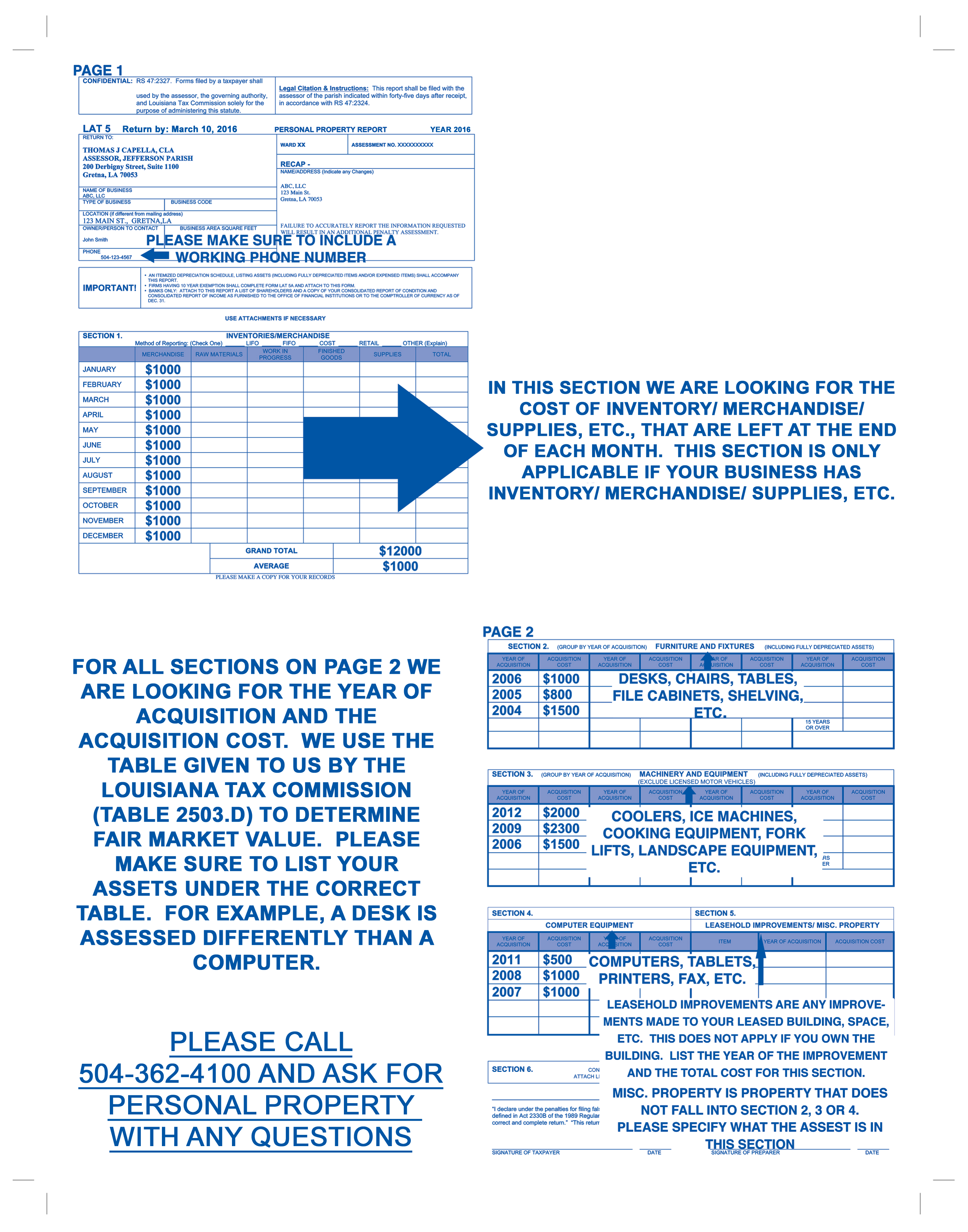

You can call the Jefferson Parish Tax Assessors Office for assistance at 504-362-4100Remember to have your propertys Tax ID.

. One of the largest recipients of property tax dollars in the parish are local schools. To opt-out of receiving tax payment receipts or other information by email at any time respond to the email with OPT-OUT. Please use the Search feature to find your property of interest.

Dba MY LOCAL TAXES offers tax payers the ability to pay their real and personal property taxes on line through actDataScout a website hosted and maintained by DataScout LLC a wholly owned subsidiary of Arkansas CAMA Technology Inc. If you have questions or comments please call our office. Please contact the Jefferson Parish Sheriff 504-363-5710 for payment options.

Tennessee has one of the lowest median property tax rates in the United States with only nine states collecting a lower median property tax than Tennessee. Hereinafter Arkansas CAMA Technology Inc. The exact property tax levied depends on the county in Texas the property is located in.

Its also worth noting that the schools in St. Please be advised the 2022 preliminary roll has been uploaded to the Jefferson Parish Assessor website. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

Administration Mon-Fri 800 am-400 pm Phone. This search will take some time because of the size of the parish so please be patient The proposed assessment lists posted on the Tax Commissions website are for informational purposes only and shall not give rise to any claim or contest regarding the assessed value of any property or the taxes due thereon. Search Arkansas real property records sponsored by the Jefferson County assessors office.

Tennessees median income is 52201 per year so the median yearly property tax paid by. Miami-Dade County collects the highest property tax in Florida levying an average of 102 of median home value yearly in property taxes while Dixie County. The median property tax in Tennessee is 93300 per year068 of a propertys assesed fair market value as property tax per year.

Lake County collects the highest property tax in Illinois levying an average of 219 of median home value yearly in property taxes while Hardin County has. The preliminary roll is subject to change. Jefferson Parish makes no warranty as to the reliability or accuracy of the base maps their associated data tables or the original data collection process and is not responsible for the inaccuracies that could have occurred due to errors in the.

Please use the Search feature to find your property of interest. Welcome to the Morehouse Parish Assessors Office property assessment records online. Due to the Annual Tax Sale this site can only be used to view andor order a tax research certificate.

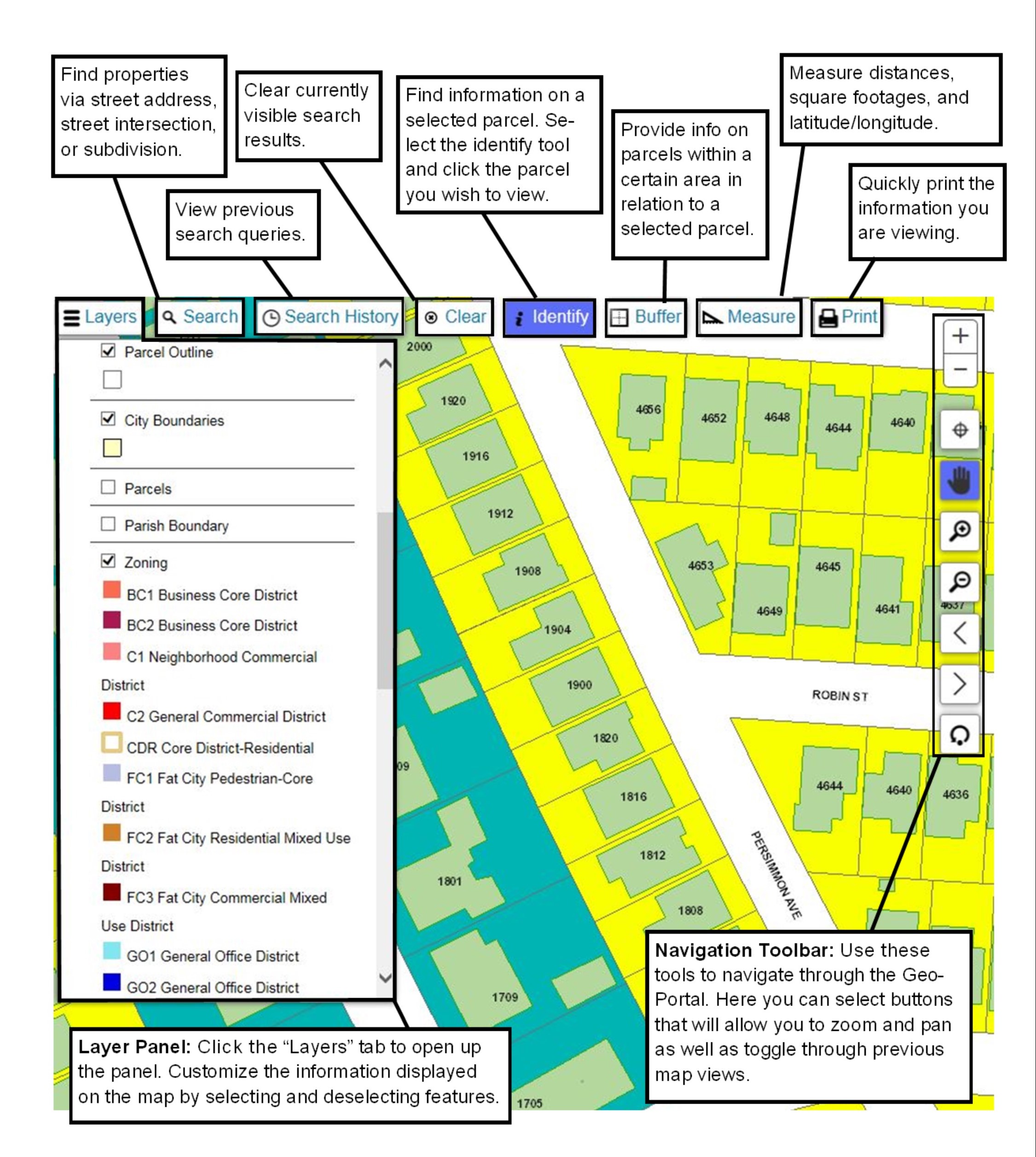

Jefferson Parish has developed a Geographic Information Systems GIS database using aerial photography and field investigations. Yenni Building 1221 Elmwood Park Blvd Suite 605 Jefferson LA 70123 Phone. To opt-out of receiving tax payment receipts or other information by email at any time respond to the email with OPT-OUT.

Parish Sponsored Pro Search Parish Sponsored Maps Plus. Welcome to the Lincoln Parish Assessors Office property assessment records online. King County collects the highest property tax in Texas levying an average of 156 of median home value yearly in property taxes while Terrell County has the.

Johnson County collects the highest property tax in Iowa levying an average of 143 of median home value yearly in property taxes while Pocahontas County has the. Please use the Search feature to find your property of interest. The exact property tax levied depends on the county in Iowa the property is located in.

The Jefferson Parish Assessors Office determines the. Tammany Parish received an A grade from the state of Louisiana in 2017. Texas is ranked 12th of the 50 states for property taxes as a percentage of median income.

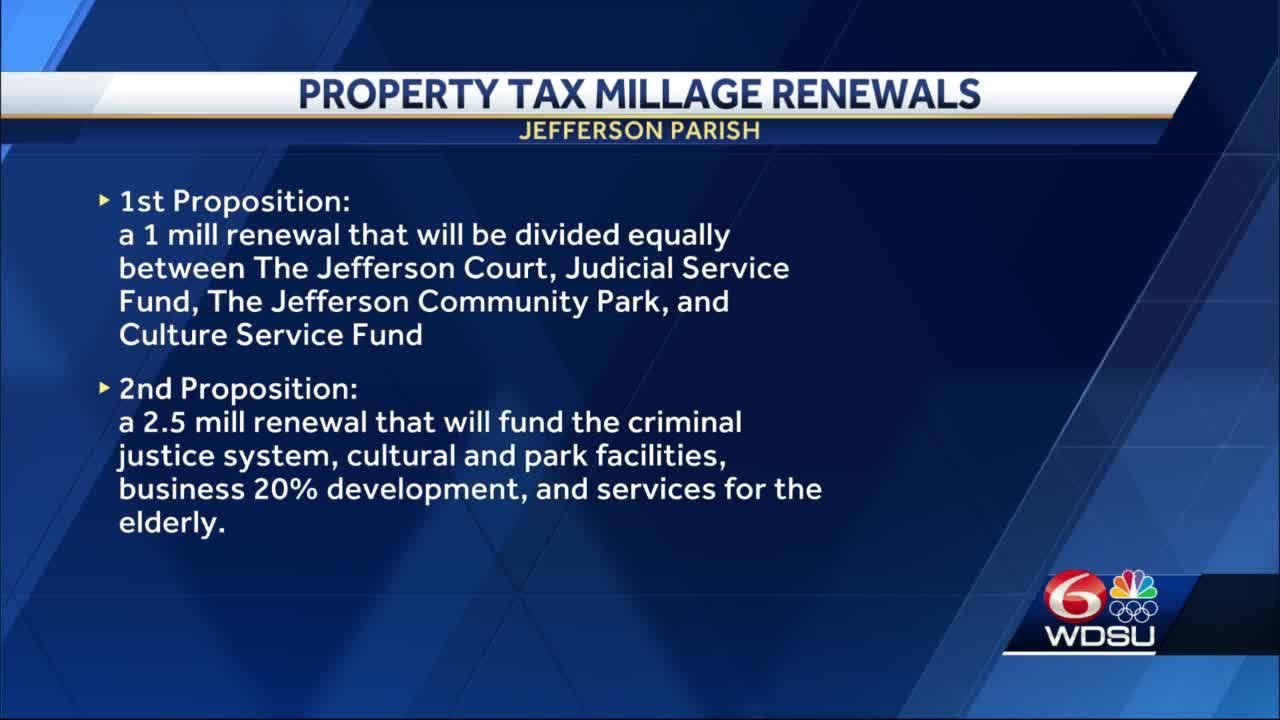

The tax rate is the sum of the individual millage that were approved by voters for such purposes as fire protection law enforcement education recreation and other functions of parish government. The exact property tax levied depends on the county in Florida the property is located in. 1233 Westbank Expressway Harvey LA 70058.

Payments are processed immediately but may not be reflected for up to 5 business days. 504 838-1110 Administration Office Hours. The exact property tax levied depends on the county in New Jersey the property is located in.

If you have questions or comments please call our office. Dba MY LOCAL TAXES. Please use the Search feature to find your property of interest.

Illinois is ranked 5th of the 50 states for property taxes as a percentage of median income. If you have questions or comments please call our office. New Jersey is ranked 1st of the 50 states for property taxes as a percentage of median income.

Arkansas CAMA Technology Inc. Florida is ranked 18th of the 50 states for property taxes as a percentage of median income. Monday-Friday 830 am - 430 pm.

Once the preliminary roll has been approved by the Louisiana Tax Commission the 2022 assessments will be updated on the website. Jefferson Parish Sheriffs Office. Parish Sponsored Pro Search Parish Sponsored Maps Plus.

Iowa is ranked 26th of the 50 states for property taxes as a percentage of median income. Library Administration 4747 West Napoleon Avenue Metairie LA 70001 Phone. JPTV is dedicated to providing informative content that is centered on government programs activities and services.

If you have questions or comments please call our office. New Jerseys median income is 88343 per year so the median yearly property tax paid by New Jersey residents amounts to approximately of their yearly income. The exact property tax levied depends on the county in Illinois the property is located in.

When contacting Jefferson Parish about your property taxes make sure that you are contacting the correct office. Jefferson Parish Property Records are real estate documents that contain information related to real property in Jefferson Parish Louisiana.

Jefferson Parish Residents Will See Several Millages On Ballot

Jefferson Parish Property Taxes Are Set For 2018 Local Politics Nola Com

Jefferson Parish Property Taxes Are Set For 2018 Local Politics Nola Com

Kean Miller Wins Major Property Tax Case At Louisiana Supreme Court Louisiana Law Blog

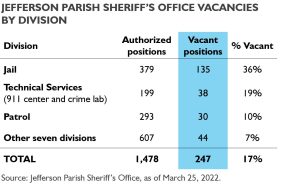

Jefferson Parish Sheriff Joseph Lopinto Will Seek Property Tax Increase For Employee Pay Raises Crime Police Nola Com

Occupational License Taxes Jefferson Parish Sheriff La Official Website

Jefferson Parish Property Taxes Due Sunday Local Politics Nola Com

Jefferson Parish Proposed New Property Tax To Pay For Teacher Pay Raises

Payments Jefferson Parish Sheriff La Official Website

Jefferson Parish Voters Set To Decide On Millage Increase To Fund Sheriff S Office Hiring Raises

Jefferson Parish Assessor S Office Property Search

Bgr Analyzes Jefferson Parish Sheriff S Office Tax Proposal

Jefferson Parish Assessor S Office Personal Property