value appeal property tax services

When to File an Appeal - Within 60 Days of the Mailing Date of your Official Property Value Notice The Department of Assessments will be mailing Official Property Value Notice 1 cards. The market value of all personal property ie.

Writing A Property Tax Assessment Appeal Letter W Examples

Paradigms real property tax review and appeal services are performed by our own consultants who are certified appraisers and former tax assessors.

. Butler County Auditor Roger Reynolds has lost his appeal over the states insistence he increase property values to 20. Tax appeals are on assessments. These experts work on behalf of the.

Value or does the ratio of my propertys assessed value to its market value exceed the upper limit of the common level range. The deadlines for valuation appeals are set by Utah State Code. Real estate value appeals may be filed after January 1 and until the adjournment of the Board of Equalization and Review usually in May each year or within 30 days of any value change.

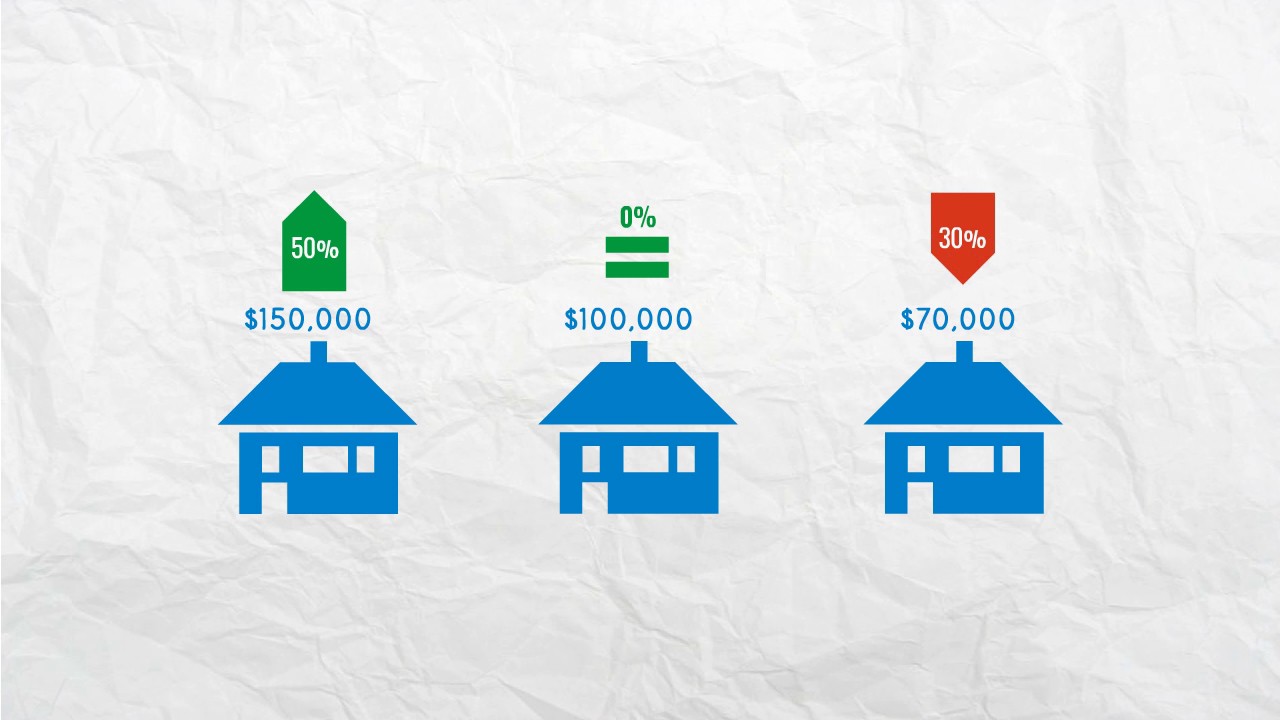

In 2011 the average ValueAppeal customer saved over 1346 on their property taxes. Property tax appeals are one area where a data-driven approach can lower costs and increase the value of multifamily real estate holdings particularly in times of unusual revenue pressure. Appealing the property tax on the parcel.

We dont want you to pay more property. The Board of Property Tax Appeals BoPTA is comprised of independent citizens appointed by the Board of Commissioners. Your classification and appraisal notice informs.

Following is a table click on link for Chapter 123 Table you can use to determine your estimated market value and the Common Level Range for your property examples are for illustrative. 2022-09-16 - By Denise G. January 1 2021 is the valuation date for the 2021 appraisal cycle.

When you file an appeal you are appealing the assessed value of the parcel in question. The appeals are filed with the Weber County ClerkAuditors Office. 1 day agoButler County Auditor Roger Reynolds lost his appeal to the Ohio Board of Tax Appeals so property values will jump an average 20 in Fairfield Hamilton and Fairfield and.

Residents may call their County Tax Board for more information. If you have value questions you may call 503 846-8826. If the homeowners appeal is rejected ValueAppeal will refund 100 of their fee.

There are three categories of appeal depending. While there is a direct relationship between assessed. Your proposed property tax notification will include an appeal deadline which can be as little as 30 to 45 days after you receive the notification but may be longer 2.

We provide residential tax appeal services specializing in high-end residential properties in Dallas Collin Denton and Tarrant counties.

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Writing A Property Tax Assessment Appeal Letter W Examples

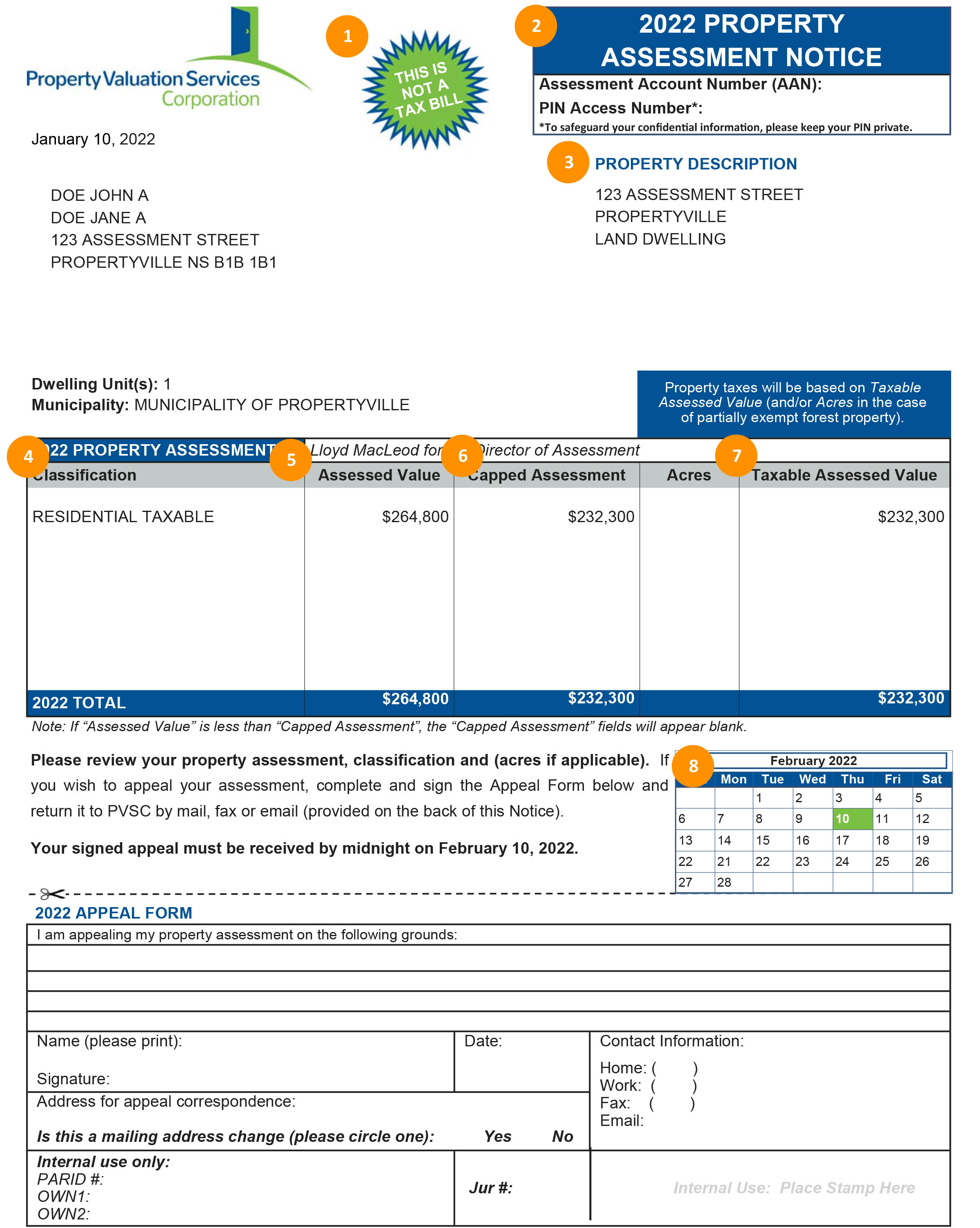

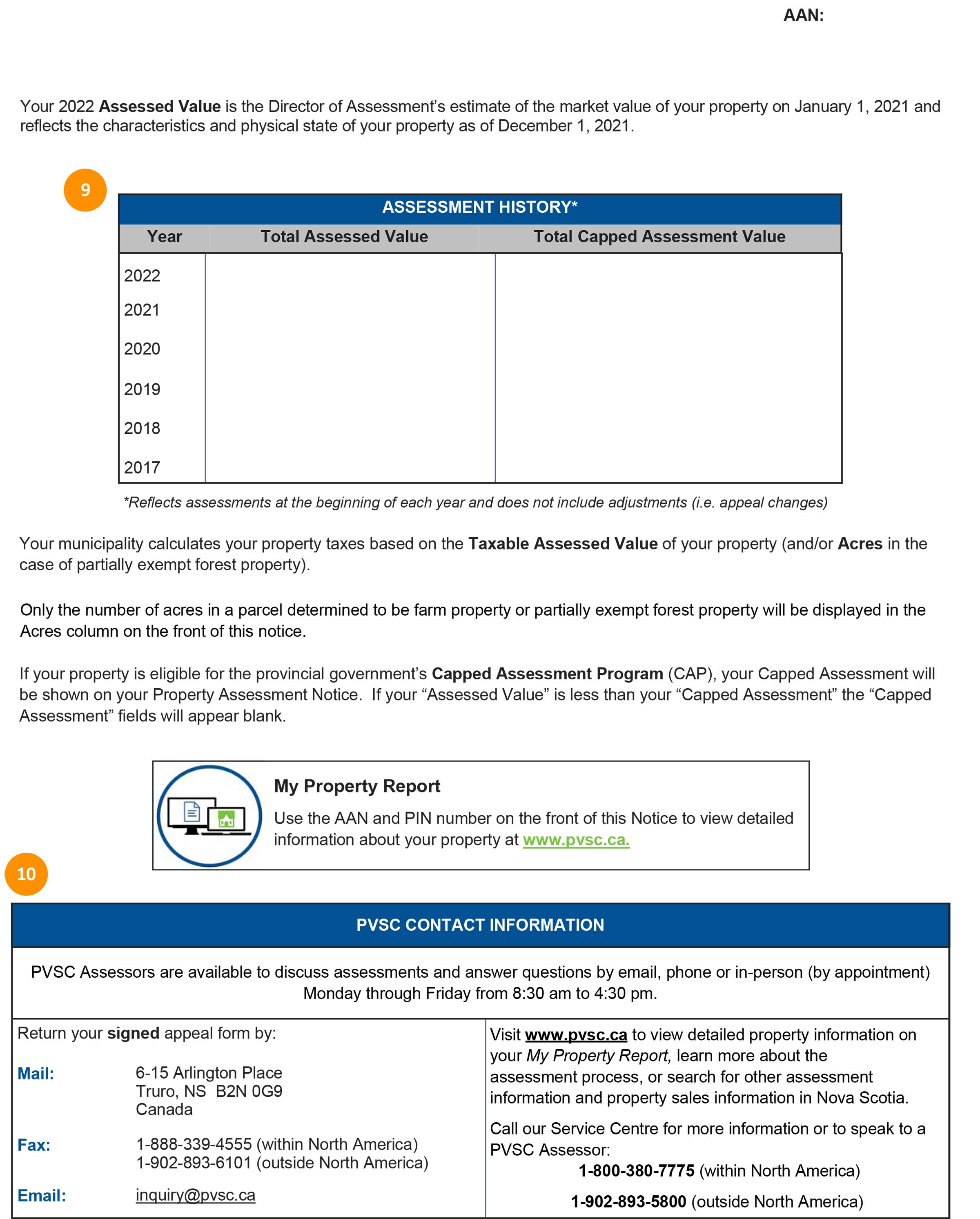

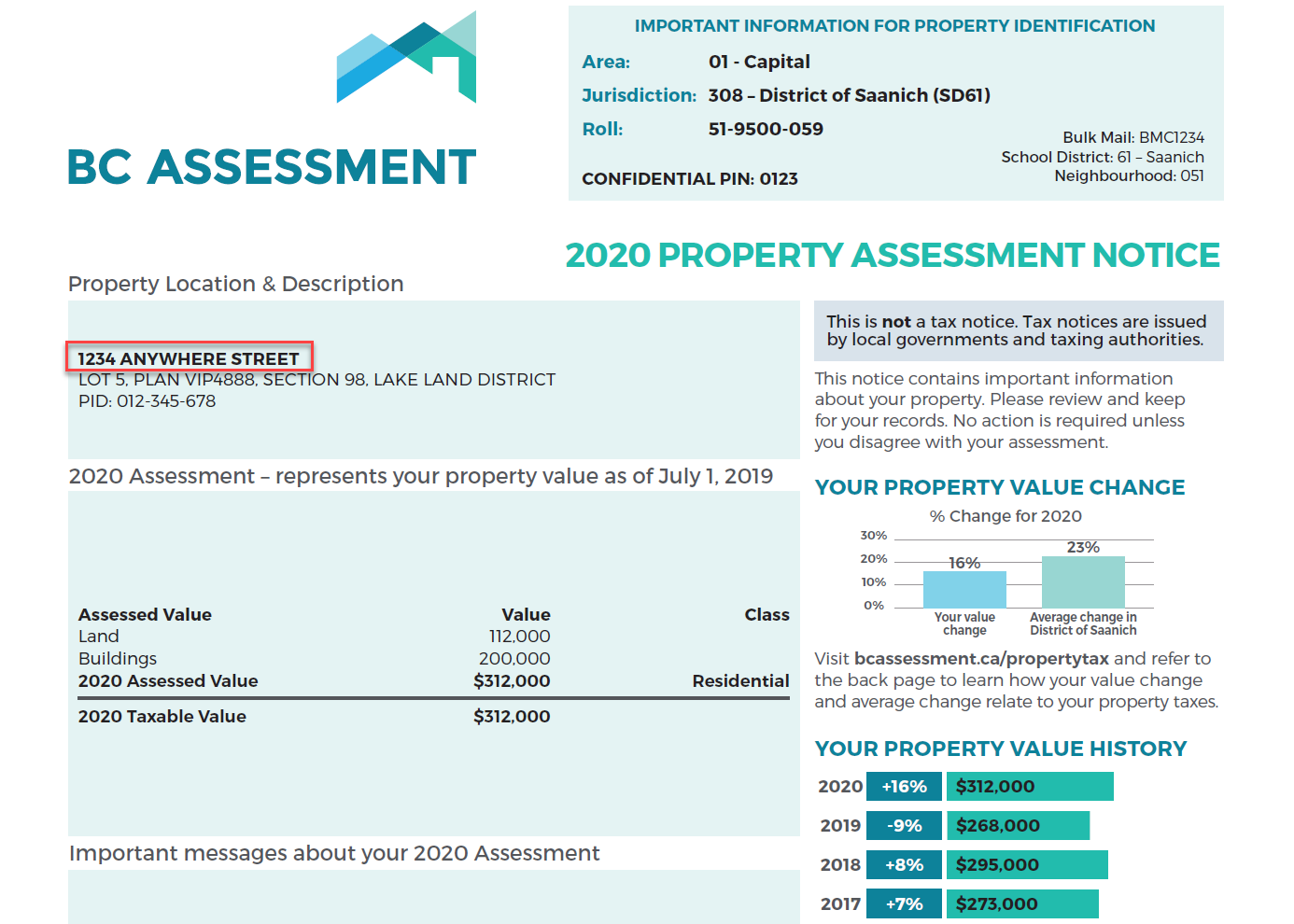

Your Property Assessment Notice Property Valuation Services Corporation

Your Property Assessment Notice Property Valuation Services Corporation

Successful Tax Appeal Tips Commercial Property Property Tax Tax Reduction

Property Assessment Assessment Search Service Frequently Asked Questions

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Frequently Asked Questions Faqs Property Assessment Appeal Board

Property Assessments Banff Ab Official Website